Did you receive $10 or more in dividends for your account(s) or paid $600 or more of interest on a Home Equity Line of Credit (HELOC)?

To check the YTD (Year To Date) Dividends you received or the total interest paid, please refer to your December account statement.

If you enrolled in Online eStatements before December 15, your tax statements are now available to print/download:

- Log in to your online banking account

- Go to Online eStatements

- Go to “Tax Statements”

In the mobile app, go to Online eStatements and scroll down to the "Tax Statements" section.

Otherwise, a copy of your tax statement(s) will be delivered to you if you receive printed statements by mail.

ADDITIONAL NOTES

- If you maintain multiple account numbers, you will receive a 1099-INT for each account that earned $10 or more in dividends.

- You will not receive a 1099-INT tax statement if the dividends you received on an account was less than $10.

- You will not receive a 1098 tax statement if you paid less than $600 of interest on a HELOC.

- If you obtained a mortgage loan through APFCU, your mortgage is being serviced by CUSO of Hawaii Services. For information and assistance, visit the CUSO of Hawaii Services website or call 808-539-0172 (U.S. toll free, 1-800-708-2876).

- You can log into Online Banking by going to alohapacific.com and entering your login credentials in the Sign In box. Click on 'Online eStatements' to download and print your tax statement(s).

- If you closed your Aloha Pacific account or paid off your HELOC before December 31, please refer to the last statement you received.

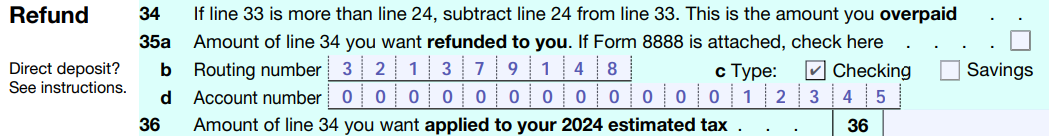

USE DIRECT DEPOSIT FOR SAFE, FAST TAX REFUNDS

A direct deposit into your APFCU account is safe, convenient and fast.

1. Routing Number: Always use the 9-digit routing number exactly as it appears.

321379148

2. Account Number: Your account number must be between 10 to 17 digits. If your account number has less than 10 digits (e.g., if it's only 5 digits), prepend it with zeros. For example, if your account number is 12345, you should enter it as 00000012345.

3. Type of Account: Specify if your account is a Checking or Savings account.

4. Double-check for Accuracy: Ensure all details are correct to avoid delays. Feel free to contact us anytime here if you have questions.

Example: